PCI DSS Compliance.

PCI DSS made simple with OmniCyber Security.

PCI DSS is the bedrock of security for any organisation handling card transactions, and it’s our expertise that ensures you navigate this certification with ease. Securing sensitive data is vital, and failing to meet these standards could jeopardise your brand’s integrity and result in substantial penalties. OmniCyber Security can be your trusted partner in achieving and maintaining PCI DSS compliance.

Get in touch for a free PCI DSS scoping call

Why Choose OmniCyber Security?

With over a decade of experience in PCI DSS and a fully qualified team, we provide expert guidance through the complexities of data security, making compliance straightforward. Our status as a Qualified Security Assessor (QSA) company also ensures that we have appropriate quality control procedures and the required technical knowledge to be able to conduct PCI DSS assessments.

At OmniCyber, we believe in simplifying compliance, not complicating it.

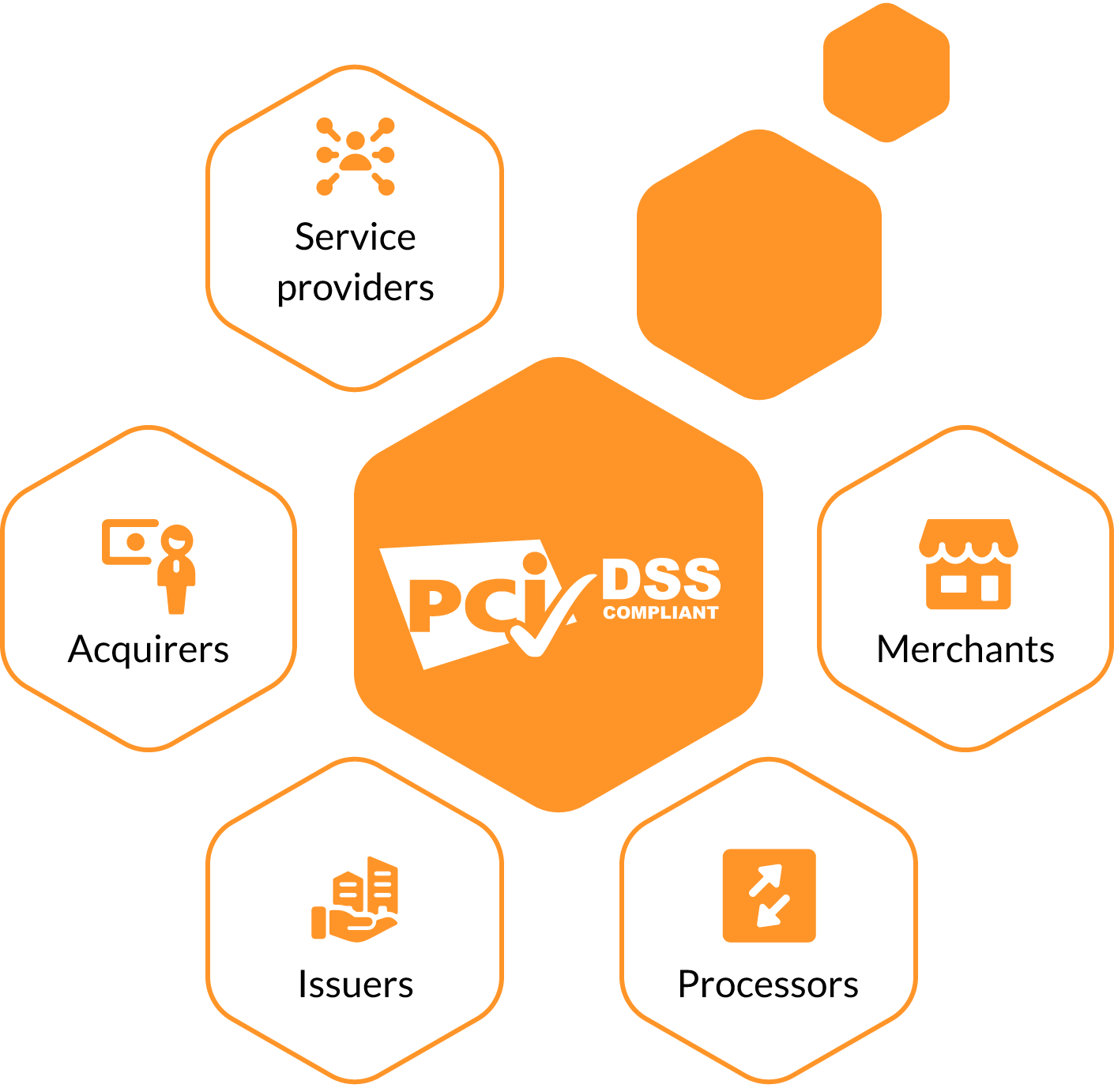

Who does PCI DSS apply to?

PCI DSS applies to any business, organisation, or company that accepts, processes, or stores credit card payments and any business that transmits cardholder data (CHD) or sensitive authentication data (SAD). Your business is responsible for safeguarding this highly-sensitive data, and PCI DSS should be a central component of your information security strategy.

Examples of the types of organisations that PCI DSS applies to include:

PCI DSS compliance for merchants is an annual contractual requirement, with fines for non-compliance. For service providers, while PCI DSS is not mandatory, your merchant clients are likely to expect that you are PCI DSS compliant to aid their own PCI DSS compliance status.

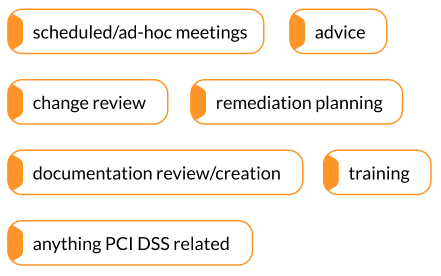

PCI DSS Consulting As A Service

Many organisations lack an in-house PCI DSS compliance expert, making it hard to access the right guidance when needed. OmniCyber Security has the expertise and personnel to provide ongoing support as and when required. We offer flexible PCI DSS call-off days that can be tailored to your requirements with hourly slots for:

Our Promise: Unlike some other consultancies, we won’t use half a day of consultancy for a 1-hour call. Our pricing is flexible, and unused days can be applied to other services.

PCI DSS With OmniCyber Security

Scope Review

If your scope is too big, you waste time and money protecting systems that may not need rigorous PCI controls. Too small, and you may not be protecting what you should. We workwith you to identify the specifics of your scope, covering payment channels, merchant/service provider levels, transaction volumes, system components, personnel, processes, and service providers.

OmniCyber will review your bespoke business processes and produce a scope diagram detailing your PCI DSS Cardholder Data Environment (CDE), which will give you confidence that all PCI DSS payment channels are covered. While this option is only required for a more detailed PCI RoC review, OmniCyber recommends this review as a minimum, so your organisation can instantly see where cardholder data is stored, processed, transmitted, and how third parties interact.

Self-Assessment Questionnaires (SAQs)

There are 10 different PCI SAQ merchant questionnaires., so determining which SAQ applies to your organisation can be challenging. As part of this service, an OmniQSA will assist you with identifying the appropriate SAQ/s and ensure you know what each applicable PCI DSS requirement means to your organisation.

Omni offers two options regarding the completion of SAQs. Assisted SAQ (aSAQ) Completion involves an OmniQSA working with you to complete the applicable SAQ/s and Attestation of Compliance (AoC) with QSA signature. Attested SAQ (atSAQ) Audit, on the other hand, requires a detailed evidence-based review to check that all answers are correct, meet the standard, and the supporting evidence supports the answer.

Gap Analysis Review

To assess your organisation’s PCI DSS compliance, conducting a Gap Analysis Review with our OmniCyber QSA is recommended. They evaluate your responses in line with your PCI DSS scope and specific requirements for each payment channel. This detailed discussion covers all aspects of your payment processes, depending on your PCI SAQ (or RoC) requirements and the involved payment channels.

A detailed report highlighting the findings will be created as the output of discussions, containing recommendations on how to reduce the current PCI DSS scope and options to reduce compliance costs and ease the burden of PCI DSS.

Report on Compliance (RoC) Audit:

For PCI Level 1 merchants (over 6 million transactions annually) and service providers (over 300,000 transactions annually), an annual PCI Report on Compliance (RoC) is mandatory, performed by a PCI QSA-certified organisation. This annual assessment includes a comprehensive review led by a QSA of your payment channels and an evidence-based evaluation of all in-scope systems, personnel, and processes.

At Omni, we leverage our industry experience and technical understanding to validate your environment against the PCI DSS standard. We ensure your defined scope is correct, and all collated evidence meets the PCI DSS standard. All client evidence is kept secure as per PCI SSC quality standards and retained for 3 years to ensure your PCI RoC is defendable if ever required.

Internal Vulnerability Management

Quarterly internal vulnerability scans of in-scope networks may be required to meet your PCI validation obligations. OmniCyber can help you meet your PCI scanning requirements with our managed scanning solution.

We will help you understand the vulnerabilities that threaten your environment by producing detailed reports that will highlight the items that need resolving to ensure PCI DSS compliance. The quarterly reports detail the severity of the vulnerabilities and offer remediation advice. This is a managed service that we tailor to your environment using a mixture of agent and IP-based scanning to help ensure all in-scope systems are tested cost-effectively.

PCI ASV External Vulnerability Scanning

Quarterly external vulnerability scans of in-scope networks may be required to meet your PCI obligations. The obligations are:

- At least once every three months

- By a PCI SSC Approved Scanning Vendor (ASV)

- Vulnerabilities are resolved and ASV Program Guide requirements for a passing scan are met.

OmniCyber can help you manage your ASV scanning requirements via our user-friendly PCI ASV (Approved Scanning Vendor) portal.

Whilst this PCI DSS requirement is quarterly, it is recommended to scan monthly (at no extra cost with OmniCyber) to ensure your network perimeter is secure.

PCI DSS ASV with Omni includes:

- Portal set-up, user guide, and walkthrough

- Unlimited on-demand and routine scanning

- Automatic ASV certificates

- Automatic vulnerability reporting and recommendations

- Easy false positive reporting

Penetration & Segmentation Testing

Penetration and network segmentation tests are an annual PCI DSS requirement (and good general security practice) depending on your PCI DSS scope.

OmniCyber utilises industry-leading tools and in-house UK-based expertise to actively identify security flaws and vulnerabilities within your internal and external infrastructure and applications. Our team will communicate any security issues throughout the test and detail their findings in a factual report, highlighting severity, and remediation advice.

Why Omni

We use industry certified techniques and tools to help clients rapidly identify and rectify security gaps everywhere their people, products and customers interact with technology.

Some of the biggest brand globally trust our highly qualified and experienced team to ensure their systems and infrastructure are secure and compliant.

Whilst our teams can be relied upon to provide excellence in a single engagement, Omni excel at helping our clients mitigate the risks of their changing threat landscape for the long term, through a bespoke delivery of compliance and security services.

PEN TESTING

Find out where you are vulnerable, before hackers do

Sometimes offence is the best defence against cyber criminals. That’s why we provide a detailed mix of IT security services like CREST certified penetration testing, social engineering, web application testing and more. We search for the security gaps and give you the streamlined recommendations you need to fill them fast.

MANAGED SECURITY

Prevention is the best medicine

The average cost of a data breach in 2019 came at the bargain price of US$3.92 million. Large enterprises have the resources to absorb a hit like this, but most businesses don’t. This is where Managed Security comes in. As your embedded cybersecurity team, we provide network monitoring and advanced threat detection to minimise your risk of business disruption.

COMPLIANCE

Safeguard data, protect your customers and yourself

Do you get butterflies when you hear the words GDPR, PCI DSS, IASME, PIPEDA, CCPA? Getting Compliance right is a big deal and gets more complicated day-by-day. We can help. Our Compliance team has all the knowledge and tools you need to integrate best practices for data privacy across your entire organization and keep you resilient in face of a data breach.